It’s a well-known fact that most companies facing insolvency call in an insolvency specialist too late; when it’s time to turn off the lights and hand in the keys. Had they called a specialist earlier, at the first hint of financial distress, the outcome could have been different, and the business could now be thriving.

Every business, no matter its size or sector, will, at some point, experience stress. In this blog, we identify the first signs of a problem and discuss how an insolvency specialist’s early introduction could assist businesses with practical advice and consultancy support and potentially build a stronger company.

With a contribution from Chis Herron, Partner at Herron Fisher (insolvency and business recovery specialists)

How do business leaders recognise the first signs of financial distress?

The first thing to appreciate is that there are many indicators of looming financial problems; some are disguised:

- Selling in a niche market that is suffering a downturn

- The leadership team is unbalanced (one dominant voice)

- A member of the leadership team is experiencing a personal crisis and is distracted

- Over-reliance on one customer

- Staff turnover is increasing

- The company is beginning to underperform

Others are more obvious:

- Lack of good quality management information (for example, aged debtors report, cashflow forecast, and net profit margin position), so the business is not on top of the numbers

- Unable to secure the next funding round or had funding withdrawn

- Overtrading (a common problem with start-ups and rapidly growing businesses)

- Loss of a significant contract

- Difficulty in paying a large bill

- Breach of one or more loan covenants

Related article | How to manage cashflow during economic turbulence

If you identify with one of these indicators, now may be an excellent time to engage an insolvency specialist and get knowledgeable advice.

Most business leaders are reticent to call, but you have nothing to lose; the first meeting is free. It does not mean you’ll be automatically taken into administration, as the main priority of all insolvency practitioners is to rescue the company as a going concern.

For example, Herron Fisher was recently called in by an SME, turning over about £1M. They had survived Covid, but the new landscape of customer behaviour had affected the business; people were not spending money and turnover, once buoyant and steady, was now erratic, causing cashflow problems every few weeks. There were two large creditors, including HMRC; both were initially unwilling to compromise, but once we had helped the company devise a plan to move forward and explained it to the creditors, they were supportive. The company survived without the need for any insolvency process. Herron Fisher remains in place as a sounding board, speaking to the directors and their other advisers regularly.

Related article | How to monitor loan covenants

What is an insolvency specialist?

According to the Association of Business Recovery Professionals, R3, insolvency practitioners and other restructuring professionals play a vital role in ensuring that the UK maintains its reputation as one of the best places in the world to do business.

- Insolvency Practitioners are licensed and authorised to act by their professional body, which in turn is authorised by the Government.

- They help financially struggling businesses to repay what they owe and, where possible, rescue the company.

- They often work with companies within formal insolvency procedures; however, if called in early enough, they can guide companies through a sticky financial patch and keep them out of insolvency and back onto a growth trajectory.

What would an insolvency specialist do in the early stages of financial distress?

A fresh pair of eyes to analyse the current status

An insolvency practitioner can bring a fresh and experienced pair of eyes and provide new perspectives and ways of thinking. Someone with no emotional attachment to the company. Someone who can dispassionately build a plan to help you bridge the gap between the current situation and the desired outcome and emerge financially stronger.

They don’t know the technical side of the business, and they don’t know your clients, but they are highly experienced finance professionals, and it’s easier for them to question the process.

Build a rescue plan

This process is unique for every company. It can be an uncomfortable process, with hard decisions to be taken. Management may often have to adapt to challenging recommendations going into the plan.

Some ideas could include the following:

- Closure of loss-making product or service lines

- Streamlining and reducing costs

- Staffing recommendations

- The introduction of new management

- Seeking to exit or renegotiate leases

- Renegotiating payment terms with creditors

- The sale of all or part of the business

Liaise with relevant external creditors and stakeholders

An insolvency practitioner can:

- Liaise with lawyers, banks, investors, HMRC, other significant creditors, and relevant parties

- Agree different payment terms

- Review a business plan and present it to stakeholders

- Help to formulate a cashflow forecast or critique their existing forecast, and discuss it with funders

- Speak to trade unions where appropriate

Give you breathing space

Liaising with creditors and stakeholders and building a rescue plan is time-consuming; while doing this, you cannot run the business. Conversely, if you keep your head down running the business, don’t build your plan and allay your creditors’ concerns, you won’t have a business to run.

“Although it never hits the headlines, Insolvency Practitioners save many businesses and jobs. It’s a wonderful thing when a business is saved by prompt intervention, commented Chris Herron. We get a nice reminder of the ‘quiet’ work we do when the Christmas cards come round and we see that a business we have worked with is still thriving.”

Related Article | How can CFOs prepare for inflation

How many companies become insolvent each year?

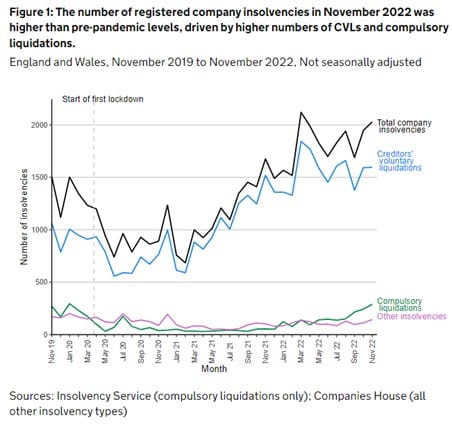

It’s a sad reality that, according to Government statistics, the number of registered insolvencies in November 2022 was 2,029. 21% higher than the same month the previous year and 35% higher than pre-pandemic figures.

With the impact of escalating inflation, increasing interest rates and the global energy crisis, expectations are that this statistic will continue to grow when figures are released at the end of January 2023.

How do I find an insolvency practitioner

You can find a list of insolvency practitioners on the Government’s website

Chris Herron BSc(Hons) FIPA FABRP is a Licensed Insolvency Practitioner with over 35 years of experience dealing with a range of different businesses with turnovers varying from tens of thousands of pounds to a hundred million. Chris trained with the Insolvency Service, moving into private practice in 1989.