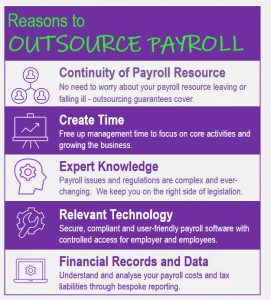

Running the payroll can be time-consuming and stressful – particularly if you’re trying to grow a business at the same time.

Our outsourced payroll service has been developed with the growing business in mind. An efficient, dependable and affordable alternative to running your own in-house payroll system.

We provide a managed payroll service for start-ups, growing and established businesses as well as the UK entity of overseas organisations.

We deal efficiently with the complexities and confidentiality of payroll, including pension rules regarding automatic enrolment, HMRC liaison and employers’ FInancial reporting requirement.