Managing Cash flow is often easier said than done

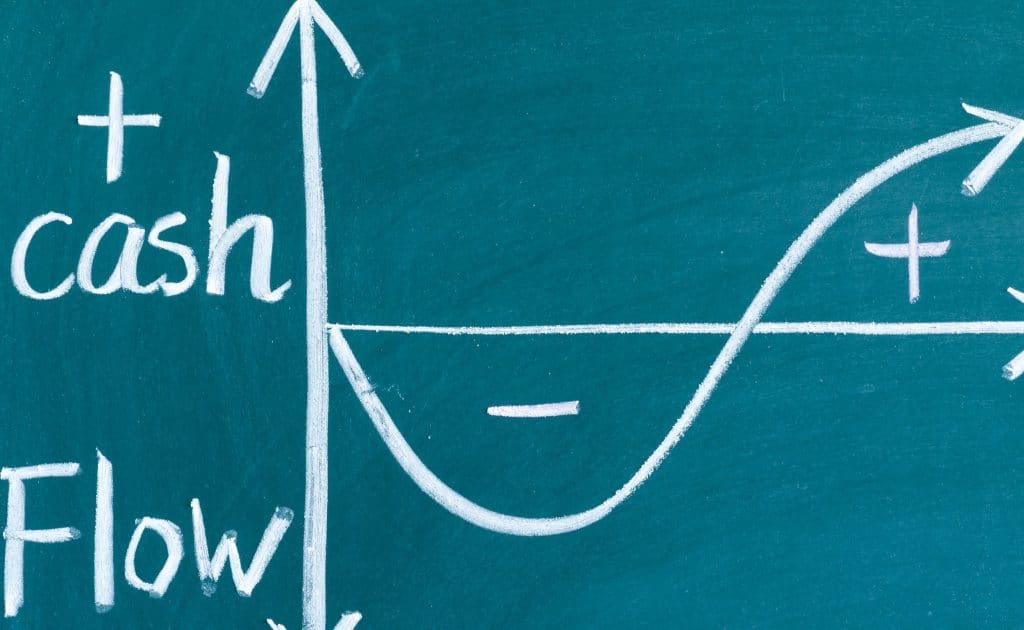

Managing cash flow during the early-revenue generating years is often easier said than done, and poor cash flow management can quickly bring a business to its knees – even a profitable one!

This is especially so in the challenging times we face right now with Brexit and COVID-19.

Related article | Coronavirus how to manage cash flow and working capital

According to the British Bank, 40,000 SMEs use invoice financing and asset-based lending in the UK.

What is Invoice Financing?

Quite often there is a significant cash flow gap between spending money to complete a project and receiving payment for it. Invoice financing releases cash tied up in the sales ledger.

For a fee, invoice financing enables the business to get paid a pre-agreed percentage (typically 70-85%) of the invoice value within 24-48 hours of issuing an invoice; the remaining portion is then paid upon collection of the full amount.

There are two forms of invoice financing, invoice discounting and invoice factoring; the main difference is that invoice discounters allow you to keep your credit control and invoicing in-house while factors chase debtors on your behalf.

Invoice discounting

Invoice discounting allows a business to keep control of its sales ledger (unlike invoice factoring) and consequently, the facility is ‘confidential’ from your clients. Additionally, the arrangements are a little more flexible than invoice factoring; you can usually choose either whole invoice discounting or selective invoice discounting – although the provider will usually set a minimum fee level and therefore invoice value to be financed.

Advantages

- You know when you are going to get paid.

- It unlocks funds tied up in invoices making cash flow more manageable.

- Unlike invoice factoring the arrangement is confidential so, your customers need never know.

- Invoice discounting is cheaper than factoring.

- It costs less than you think; you should expect interest rates of between 1.5% to 3.0% above base rates plus a management fee of between 0.2% and 0.5% of turnover. So, if invoices are paid within 30 days the total charge could be less than 1%.

Cons

- You will need to prove you have a robust in-house credit collection process to be accepted by an invoice discounting lender. Otherwise, you may require invoice factoring instead.

- Providers will often take security over assets.

- Only a certain percentage of your sales ledger can be made up of a single customer. This stipulation can be very difficult for some small businesses where a significant proportion of their outstanding invoices are due to one or two customers.

- Another problem with invoice discounting is it tends to get you in a hole that you cannot get out of. When you are relying on immediate payments to pay your bills, you may never be able to get ahead and stop using invoice discounting.

- You also need to remember you are ultimately still liable for the loan.

Invoice factoring

Invoice factoring is generally but not solely used by younger companies who do not have an established credit collection process. The factoring company will usually take over responsibility for your sales ledger and responsibility for obtaining payment from your customers; typically the facility is ‘disclosed’ so your clients will be aware that they are paying invoices to a factoring company.

Although some providers do offer spot factoring (allowing selective factoring of specific invoices), most provide a whole of the turnover facility only (which means all invoices and all customers are included).

Advantages

- You know when you are going to get paid.

- It unlocks funds tied up in invoices making cash flow more manageable.

- The funder manages your credit control and sales ledger management.

Cons

- More expensive than invoice discounting. You will typically pay between 0.25% and 2% of turnover as the service charge plus between 1.5% and 4.5% over base rate against the drawn funds (Source: Moneyfacts.co.uk)

- With a third party contacting your customers, valuable relationships could be tainted.

- As facilities are ‘disclosed’ your customers will be aware that you are using a factoring company. It can make the business look like it is struggling financially; it can look like you need to borrow money just to meet short-term obligations.

- Only a certain percentage of your sales ledger can be made up of a single customer. This stipulation can be very difficult for some small businesses where a significant proportion of their outstanding invoices are due to one or two customers.

- Providers will often take security over assets.

- Most factoring companies will lock you into an extended contract which is often costly and difficult to get out of.

- Another problem with invoice factoring is that it tends to get you in a hole that you cannot get out of. When you are relying on immediate payments to pay your bills, you may never be able to get ahead and stop using invoice factoring.

- You also need to remember you are ultimately still liable for the loan.

How to find invoice financing providers

There are quite a few providers of invoice financing to choose from — ranging from small local providers with a few dozen clients to larger providers with thousands of factoring customers. Here are the Top Ten Providers of Invoice Financing in the UK; this list also includes some of the newer fintech companies who are challenging the traditional providers and innovating this space by introducing a bit more flexibility into their arrangements.

Is invoice financing right for my business?

There are many different types of funding options available for growing businesses who need help managing their cash flow. The High street banks have strict rules and often services companies (who are not dealing with tangible stock) struggle to get finance from the typical providers. Invoice financing is designed to meet the changing needs of growing businesses particularly service companies.

You may be interested in a couple of other relevant blogs we have written about funding:

Related Article | What’s the right investment route for the growth potential startup?

But if you need our help, please get in touch, we would be delighted to hear from you info@ifteam.co.uk

(Image Source: Shutterstock)