Understanding the steps of selling a business is relatively straightforward, but knowing how to increase the value of, and effectively market a business is something completely different.

An M&A adviser’s role effectively encompasses three things:

- Marketing your business to several potential, interested buyers, and

- Negotiating the sale on your behalf alongside other advisers, such as lawyers, and

- Achieving the very best possible outcome for you, the seller, in terms of price

The main benefit, however, of using an M&A adviser is that they will ensure the management team are not distracted and can continue to run the business – ensuring continued successful financial and strategic performance. The last thing you need is to reduce your business’ performance and lose clients, talent or money, as these are all critical factors that will impact the final price you achieve for selling your business.

The Role of an M&A Adviser

- Thoroughly explain each phase of the transaction process to ensure that you understand what to expect

- Analyse the performance of your business and, if appropriate, work with you to ensure that it is ready for sale (this may take six months to two years and varies from business to business)

- Provide you with a fair valuation of your business to give you an indication as to what it is worth

- Work with you to put together the necessary documentation such as business plans, financial forecasts and management presentations

- Market your business (get it in front of the right people at the right time) and create competition for it (increase the value of the offers)

- Working with other third parties, steer the process to ensure that all the necessary due diligence and legal documentation is prepared promptly

- Manage the initial responses, vet potential buyers and ensure that only those buyers with a real interest in acquiring your business make it to the next stage of the process

- Arrange and attend meetings (with you as appropriate) with potential buyers and provide them with the necessary information required to make an offer for your business

- Once due diligence is complete negotiate with the buyer or buyers to agree the best deal possible for your business

- Prepare all sale documents and ensure that critical areas such as Earn Out, Tax and working capital are agreed between both the seller and the buyer (thereby minimising the chances that a sale will not be agreed!)

- Finalise the Sales and Purchase Agreement alongside the seller and the lawyers

Related Article: Selling a Business? Share sale or asset sale

Related Article: Selling a Business? Cash, Earn Out, Loan Notes or Shares?

Related Article: Selling a Business: Entrepreneurs’ Relief

When is the best time to involve an M&A Adviser?

In a perfect world, the best time to involve an M&A adviser is at the beginning, while you are still thinking about selling your business. There is then time to prepare the business properly to maximise its value. Of course, no two sales are the same, and this isn’t always practical, as you may have received an unexpected approach, for example. So we would say the earlier, the better but whatever stage you are at it is never too late to bring in an M&A adviser.

How do I choose an M&A Adviser?

Choosing the right adviser for your business will have a direct impact on how quickly the sale goes through and on the price you will ultimately achieve.

The size of the transaction will be a significant factor when determining which type of adviser to approach. It’s difficult to pigeon-hole advisers into specific transactions sizes, but as a rule of thumb:

- A full-service investment bank (JP Morgan or Goldman Sachs for example) are usually looking to advise on transactions above £500m

- Mid-market M&A advisers (like PWC, KPMG or Ernst and Young) are generally looking at transactions between £100m and £350m

- A specialist M&A boutique like Isosceles focuses on transactions anywhere between £5m and £100m

- The business broker is less than £5m

There’s a lot to consider when choosing an adviser, but the key elements are; experience, process, team and fees.

Experience

Do they understand your business and your industry? What is their knowledge of selling similar businesses to yours? How many deals have they closed? How successful have they been in achieving premium valuations? Take up references. How will they market your business? What contacts do they have among potential buyers?

Process

What is their process? How disciplined are they? It should be documented, ask to see a copy. Will they work hard throughout the entire process to position your company for a successful close? Or will they cut corners? How will they keep the sale confidential?

Fees

What are their fees? How are they structured, and what do they cover? How do they compare with their competition?

Team

Who are the team? Will your transaction get the time and energy it deserves? What are their experiences and track record? Do you like them? Trust them?

How much does an M&A Adviser charge?

Selling a business is a time-consuming exercise, and in general, it can take anywhere from 6-12 months to sell a business. Fees will vary depending on which type of M&A adviser you decide to engage and what the expected sale value of your company will be.

Generally speaking, M&A advisers will charge two fees; an engagement fee or retainer and a separate success fee.

Engagement Fee/Retainer

This fee can either be charged up front as a standard flat fee or invoiced monthly. The fee is usually agreed up front and could be anywhere from £30,000 to £100,000 or more. The exact amount will depend on the experience of the firm handling the transaction, the size of the transaction and the amount of up-front work required to take the opportunity to a successful sale.

The objective of an engagement fee/retainer is to commit the seller, commit the M&A adviser and cover the adviser’s fixed costs.

Success Fees

The success fee incentivises the M&A adviser to achieve the highest possible price for the seller. Interestingly, the success fee charged for a smaller size transaction is disproportionally large when compared to a more substantial transaction. This is because the amount of work required to sell a £5m business is usually the same as the effort needed to sell a £50m business!

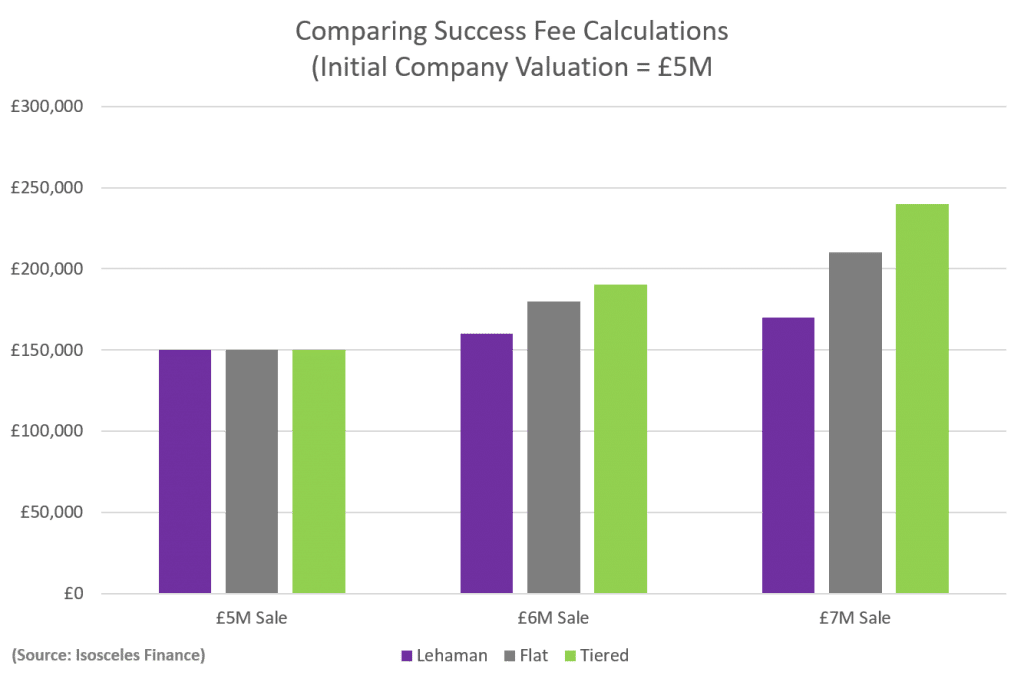

- A success fee, using the Lehman Formula also referred to as the ‘decelerator’, would be calculated as follows: 5% of the 1st £m in value of the transaction, plus 4% of the 2nd £m, plus 3% of the 3rd £m, plus 2% of the 4th £m, plus 1% of each £m thereafter

- A Flat Fee is very straightforward. It’s an agreed flat percentage of the deal no matter what the size. In our example, we have used 3%.

- A Tiered Fee is the opposite of the Lehman Formula and is often referred to as an ’accelerator. The M&A adviser’s success fees are a more significant percentage of the last £m than the first £m. For example, 3% of the first £5m of the transaction, plus 4% on incremental value up to £6m, plus 5% above £6m.

Hiring an Adviser

Take your time investigating and interviewing M&A advisers and learn as much as you possibly can in the process. Ideally, build up a relationship with an M&A adviser as early as possible as that way, you will be able to see whether they can perform the various tasks that they have agreed to do.

When meeting with M&A advisers, you will hear a lot of great success stories but don’t just take their word for it, seek evidence in the form of case studies, client testimonials and feedback. Look at their process documentation and samples of their work and talk to the team who go out on a day to day basis and work with businesses just like yours.

(Image Source: Shutterstock)